- Current digital banks run by commercial banks struggle to gain scale and new entries this year will face a market tightly held by commercial banks

- More than 90% of mobile phone users own a smartphone and more than 55% of those have made a mobile payment transaction in 2019

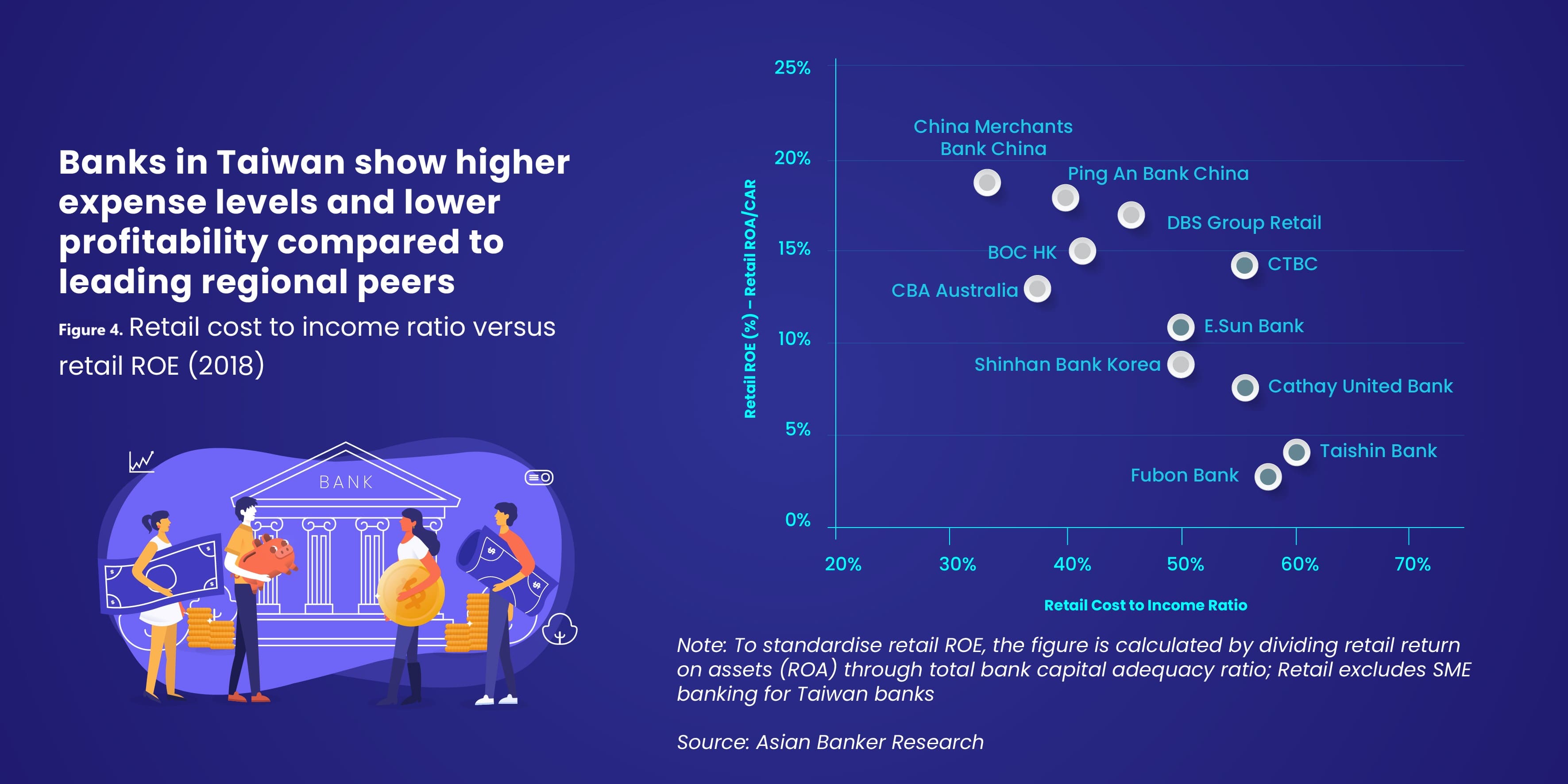

- Despite rapid digitisation among commercial banks, cost efficiencies and profitability lag behind leading regional peers

Commercial banks hold a tight grip on retail banking assets and deposits on the island where new financial services players are a few, compared to other peer markets such as Korea, Hong Kong or Singapore. This leaves the banks’ digital innovation with limited options but to innovate digitally from inside the organisation rather than to make non-linear leaps ahead by cooperating with other ecosystem players.

While deregulation is opening the doors to new digital offerings and paving the way for fintech development in Taiwan, the country has lagged behind. Compared to the rest of Asia, there are currently less than 60 fintech players operating in Taiwan, in contrast to around 350 in South Korea and 1,060 in Singapore, and none of them has made a dent yet in this market. The only exception is Line Pay, the payments arm of Japan-based social messaging app LINE. It is the leading payments platform with more than 6.2 million monthly active payment users in a country which caters to a working population of 17.2 million, defined as those between 15 and 64 years old.

There are a couple of digital banks operating in this market but are add-ons of commercial banks or operate with a commercial bank DNA such as Richart by Taishin, O-Bank and Koko. Richart has the largest user base and offers more comprehensive services, including lower minimum investment amounts for savings and wealth products. But all are struggling to gain scale compared to the digital base of commercial bank.

A new wave of full-scale digital banks plan to enter this market in 2020. The island’s Financial Supervisory Commission issued its first virtual banking licenses to three consortiums led by Taiwan and Japanese investors in mid-2019, including Japanese app operator LINE Group, Taipei Fubon Commercial Bank and Standard Chartered.

The other licences were handed out to Next Commercial Bank – led by Taiwan telecom operator Chunghwa Telecom – and Rakuten International Commercial Bank, which is run by Japanese e-commerce firm Rakuten. Taiwan’s IBF Financial Holdings also received a licence.

They may focus on specific segments and markets as they face a strong pool of first tier banks which have rapidly digitised their front end and built up a strong scope of digital and social media channels, including sophisticated digital payment tools. Leading banks such as CTBC have started working on providing same-service experience on multi channels by integrating the information flow from all channels including physical, digital and via call centres. The ultimate goal for these banks is to collect customer information and behaviour from multi channels, then leverage big data to provide tailormade service and a seamless experience across channels. Banks, however, have yet to deliver a more personalised and simple interface to its banking customers.

These developments come at a time when Taiwan is stepping into an ageing society. By this year, the proportion of the age group 65 and above is projected to reach 28%, while the rise of the millennials will force banks to adapt to their digital banking behaviour. Finance has neglected the unique needs of close to 100,000 new startups annually. Curating them into small and medium-sized enterprises (SMEs) will become increasingly important.

Incumbents and potential new digital entries into this market respond to a rapid development of digital devices in recent years, where online banking and mobile applications have become the main channels that customers use to fulfill their financial needs. Taiwan’s mobile payment penetration has increased to 50% in 2018 among around 18 million smart phone users and is expected to exceed 60% by 2020. This is further supported by a customer survey conducted in 2018 by a first tier bank in which 81% of digital users considered digital banking service as the key factor when choosing a bank. On the other hand, 82% of digital users thought the core of digital banking service were about frictionless digital banking experience and the immediacy to connect with service teams when dealing with problems.

For banks, regulations were a drag on higher level digital sales. There are three types of digital accounts with different electronic know your customer restrictions. Banks offer mobile account opening for deposit lite accounts with certain restrictions on size and limit of transactions, and most of these qualify for two out of three. For specific business accounts such as wealth management, customers can already fully open an account online and buy a mutual fund. Banks also allow customers to open accounts beyond office hours via video teller machine, obtain ATM cards, and complete all e-banking setup all at once.

The digital active retail customer base of leading banks ranges currently from 28% to 34% as measured by at least one transaction within three months. This may indicate that a substantial amount of customers continues to be tied to branch banking activities. Digital banking is not as prevalent as in China, Korea or Hong Kong and banks continue to issue passbooks to their clients. At the same time, branch numbers have declined less in recent years as compared to other mature markets in Asia. Branch decline in Taiwan started in 2015 and stood at 215 per million population as of 2017, compared to 218 in 2015. By contrast, Hong Kong counts 165 per million population and Korea 133 in 2017.

Despite a more branch-centric customer behaviour, banks in Taiwan have invested heavily in digital frontend infrastructures. For instance, leading banks introduced non-scripted text-based chatbots in 2017, which process 30% to 40% of all customer queries. At CTBC Bank, chatbot capabilities have extended across all digital and social media channels with a seamless handshake into real person assistance.

Banks have linked to LINE Connect services, and offer various financial services via the social media platform. CTBC has achieved the best integration since 2015 with strong uptake on LINE Pay credit and debit cards and new bank account opening.

Most banks, however, continue to have real issues with capturing the digital value created. While these track most transaction from digital and the revenue it generates, the multi-channel nature of user behaviour results in the incomplete attribution of income streams and costs for digital segments, thus hampering the ability to fully reconcile digital into group finances and general ledger. This remains a general issue with most banks in Asia.

Despite high levels of digitisation, cost efficiencies and profitability lag behind leading regional peers pointing to deeper issues with organisational inefficiencies, ageing core platforms and siloed structures.

A small number of Taiwan banks are adapting open source technology and incorporating big data, machine learning and robotic process automation in their banking services. Leading first tier banks already have big data infrastructure. Applications are mainly focused around payments, call center services and speech processing, fraud and cybersecurity.

In Taiwan, only non-personal customer information and services are permitted to be published on public cloud. Leading banks have started to develop its cloud computing architecture and gradually transferring data to cloud, such as eLearning for employees. However, on average, less than 4% of total bank-wide eligible servers in leading banks have been migrated so far to a cloud environment.

Taiwan’s evolving retail banking balance sheet: Anemic growth with a focus on SME banking

We expect an improved outlook for retail banking in 2020, driven by knock-on effects in wealth, personal loans and mortgages from corporate repatriation. Taiwanese companies operating in China are in the process of partially bringing supply networks and production back to Taiwan, driven by government incentives and the uncertainty associated with a potential trade war with China. According to the Ministry of Economic Affairs, more than 150 Taiwanese companies with overseas operations have pledged to bring back investment in excess of $19.6 billion (TWD 600 billion) and create over 52,000 new jobs locally.

Between 2013 and 2018, the industry’s retail loans, including credit card revolving balances, increased at a compounded annual growth rate of 3.4%, from $234 billion (TWD 7.01 trillion) to $277 billion (TWD 8.28 trillion). Consumer loans make up 29% of total loans in 2018.

In line with retail loan growth, Taiwan’s industry retail revenue grew on average by 4.3% annually between 2013 and 2018. The industry is expected to generate gross revenue from retail banking at a size of close to $11 billion (TWD 325 billion) in 2019.

Unsecured lending already highly digitised among leading banks

The unsecured lending market is mature but still growing, and existing players make market conditions ultra-competitive. Though most of the banks in Taiwan provide online application service of personal loan, the target audience is limited to existing customers who already own a credit card or savings account. Regulations in Taiwan do not allow yet end-to-end digital underwriting for asset products for new bank customers.

Taishin’s digital arm Richart has offered a digitised personal loan application since 2017. More recently, it created a smart personal loan experience with a 100% online application and a disbursal time of 30 minutes. Customers can finish the whole application process in the app by using optical character recognition technology.

CTBC Bank runs automated lending campaigns for its loans across all digital and social media channels supported by big data decision making and greater process integration. It has alliances with third party platforms offering embedded lending portals. Digital applications across channels contribute more than 80% to total personal loan disbursements.

Innovation comes to mortgage loans through flexible repayments and increased back office automation

In Taiwan, average mortgage duration is between 20 to 30 years. Banks have improved flexibility of repayments and offered online applications to customers.

SinoPac was the first bank in Taiwan to extend from 20 to 40 years, offering the maximum loan-to-value, ratio which lowered the monthly payment by 60%. Customers can indicate their home address and calculate how much they can borrow, with instant online appraisal and credit limit calculation in about 30 seconds. One factor for its speedy processing is due to the number of required information. SinoPac only needs six, whereas other banks may require about 17.