Driven by shifting geopolitics, regulatory change and technological innovation, trade and supply chain financing (SCF) is undergoing marked transformation. Tariffs and resource nationalism are reshaping trade corridors, pushing banks and businesses to rethink trade-transaction management, keeping risk mitigation, efficiency, and resilience as priorities. Central to this shift is supply chain de-risking, as well as the rise of artificial intelligence (AI), automation, and digital platforms.

In a multi-polar world, companies and banks are accelerating investment in trade finance and financial supply chain management (FSCM). Long reliant on manual, paper-based processes, trade is beginning to modernize, fuelled by regulatory reforms and digital innovation. Adoption of frameworks such as the Model Law on Electronic Transferable Records (MLETR) and Electronic Trade Document Act (ETDA) promises equal legal status for electronic trade documents, cutting documentation time and cost while streamlining entire trade processes.

APIs lead digital transformation of trade finance processes

Despite growing disruption and fragmentation in global trade, further compounded by the tariff situation, there is a renewed industry focus on accelerating digitalisation. Supply chains generate rich financial and non-financial data, which banks can tap into using digital technologies such as application programming interfaces (APIs). These allow banks to embed trade services directly where customers operate, supporting use cases like reconciliation, compliance automation and digital documentation.

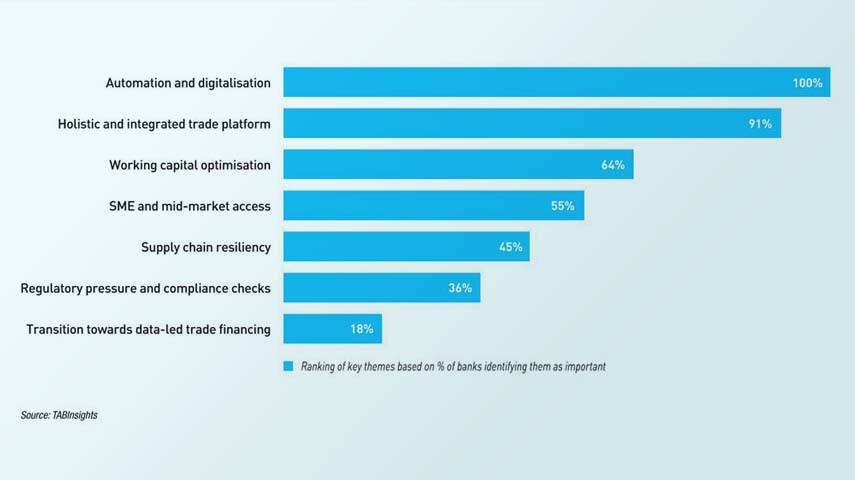

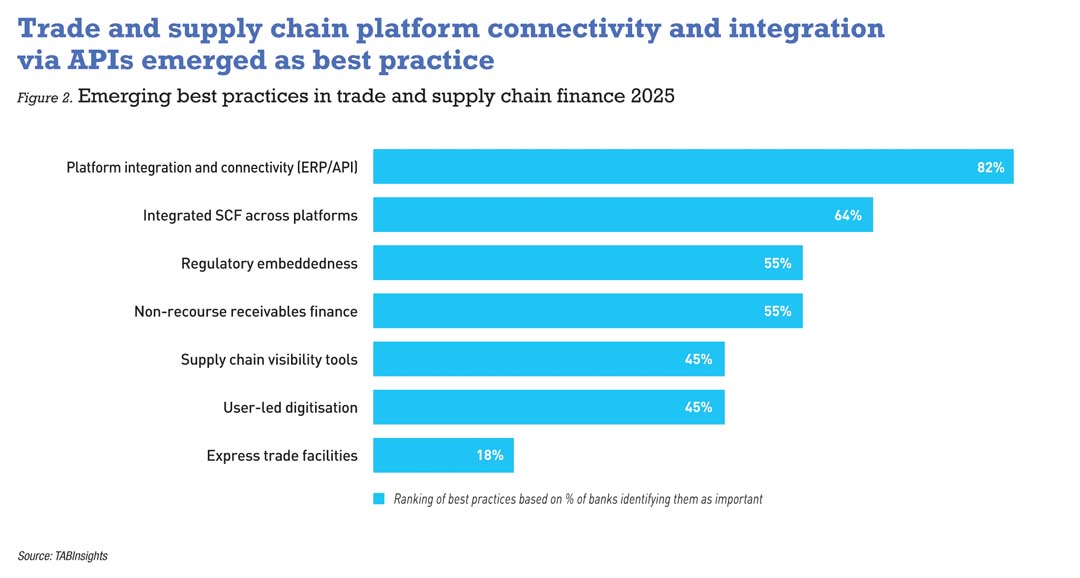

According to the TABInsights Asia Pacific Trade and SCF Survey 2025, 82% of bank respondents noted increased integration and seamless connectivity via APIs and enterprise resource planning (ERP) as a top best practice. The survey is conducted annually between January and June as part of the TAB Global Transaction Finance Awards Programme, capturing insights from over 50 banks on key trends and best practices in trade and supply chain finance.

This enables banks and corporates to connect their systems in real time, enhancing data sharing, automating processes and enhanced transparency across the supply chain.

Deutsche Bank, for example, has developed an API-first Trade Finance Gateway that integrates directly with clients' ERP systems. The gateway automates trade finance processes, including document submission, approval, and compliance checks, while enabling real-time transaction tracking. It also supports end-to-end digital documentation, covering instruments such as letters of credit (LCs), bills of lading (BLs), and invoices, reducing reliance on paper documents and manual verification.

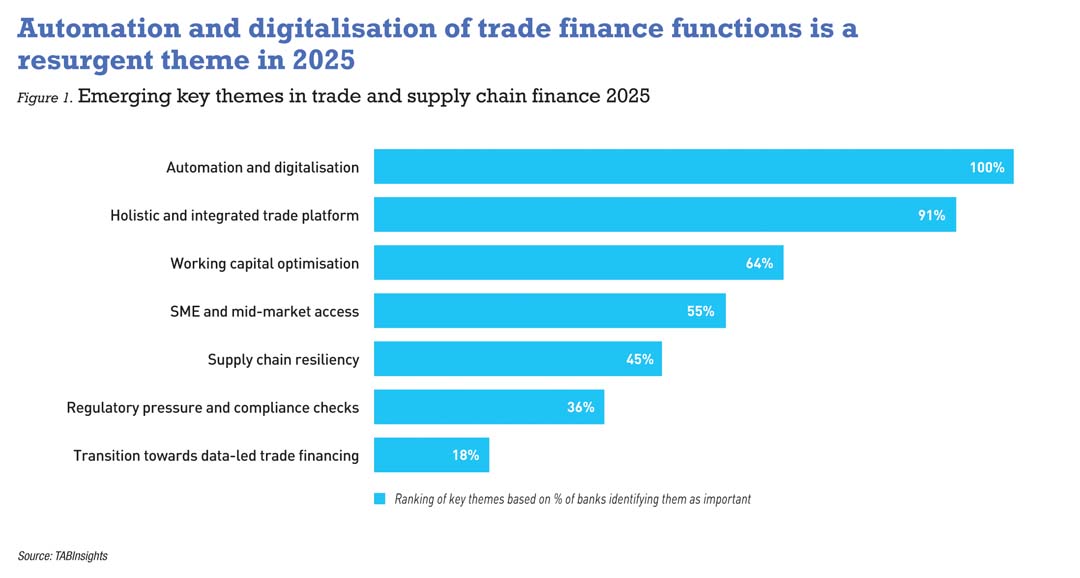

TABInsights Asia Pacific Trade and SCF Survey 2025 further highlighted digitalisation as the leading trend in trade finance, with 100% of respondents identifying automation and digital tools as key to improving speed, accuracy and security. This marks a sharp rise from 62% in 2024, underscoring the urgency of tech adoption. Document processing and verification, traditionally one of the most time-consuming tasks in trade, is now being transformed by technologies like optical character recognition (OCR) and natural language processing (NLP). These AI-driven tools can scan and extract data from trade documents in minutes, cutting processing times from days to near-instant.

Automation and digitalisation of trade finance functions is a resurgent theme in 2025

Leveraging APIs and automation, Bank of America has implemented Open Account Automation (OAA) to significantly enhance operational efficiency for corporate treasurers and trade finance officers. By automating the procure-to-pay process, OAA reduces invoice approval times from weeks to mere seconds. The system uses APIs to aggregate data from clients’ logistics platforms and suppliers’ ERP systems, accelerating and automating invoice approval.

For treasurers, this means faster reconciliation and more accurate working capital forecasting, as invoice matching and approvals are automated. Additionally, OAA integrates financial and physical supply chain data into a single platform. This streamlines workflows, reduces reliance on paper-based processes and enables real-time processing of invoices. This not only shortens transaction cycles but also improves liquidity management by accelerating access to financing.

To streamline and simplify cash flow management and SCF for corporates, banks are fast-tracking integrated experiences across trade finance, cash management, payments and SCF product stacks. United Overseas Bank (UOB), for instance, enables clients to manage payment, collections, treasury, trade and FSCM via a single login on its UOB Infinity platform. Corporate treasurers can process trade invoices, supplier and accounts receivable financing and distributor financing within one platform. API integration enables real-time transaction processing and visibility, allowing corporates to synchronise cash flow with SCF needs.

From an institutional client perspective, BNY offers a Trade Network Access Service (TNAS), which is reshaping how banks manage cross-border trade finance by automating access to the global Swift network for documentary trade. TNAS offers a self-service portal that allows financial institutions (Fis) to view and route LCs via BNY’s extensive network of over 4,000 live relationship management application (RMA) connections. The platform solves a critical pain point by eliminating the need for BNYs institutional customers to maintain their own Swift RMA infrastructure. The digital trade finance solution reduces overhead, enabling seamless, connectivity with counterparty banks globally to settle trade LC payments via the correspondent bank RMA network.

Through TNAS, banks can act on LC requests quickly, using BNY as an intermediary. Supporting both import and export transactions, TNAS allows institutions to bypass legacy workflows such as email or phone-based instructions, thereby streamlining operations.

Platform growth accelerates as banks overhaul legacy systems

Trade finance platforms are experiencing significant growth as banks pursue greater operational efficiency, improved customer experience, and the modernization of legacy systems. While many banks still rely on outdated infrastructure, the shift is being accelerated by cross-industry collaborations that are advancing the move toward a digital trade ecosystem.

With service quality now a key differentiator, the demand for user-friendly, integrated trade platforms with intuitive interfaces and streamlined workflows has surged. According to the TABInsights Asia Pacific Trade and SCF Survey 2025, 91% of respondents cited holistic and integrated trade platforms as the second most important trend, while 64% highlighted integrated SCF platforms as the second most important best practice. This is particularly evident in collaborations between banks and e-commerce or supply chain platforms, where businesses can access trade finance directly from the platforms where their transactions originate. For banks, such partnerships enable real-time data exchange and the use of alternative data points — including sales orders, inventory levels and payment histories — to improve trade facilitation.

One example is Maybank’s integration with PracBiz, a procurement-to-payment system used by NTUC FairPrice, Singapore’s largest retailer. By leveraging transactional data, Maybank can offer supplier financing without requiring buyer approval or additional financial data. This paperless, API-powered solution allows suppliers to access working capital based on live sales data. The platform also automates receivables verification and payment disbursement, reducing manual intervention and streamlining the process. This collaboration demonstrates how digital automation can optimise trade finance workflows and improve efficiency.

A similar initiative is underway at Vietnam’s Joint Stock Commercial Bank for Investment and Development (BIDV), which is set to launch a new trade platform that integrates services spanning banking, customs and warehousing into a single digital ecosystem. Like Maybank’s approach, BIDV’s platform will enable seamless data exchange and automated workflows across all trade stakeholders in the trade value chain. Real-time access to critical data will not only streamline operations but also improve decision-making for corporate clients.

These initiatives highlight a broader trend: seamless integration between banks and e-commerce platforms is redefining trade finance. By harnessing automation, real-time data and embedding financing, banks are enhancing the value and transparency of the trade finance ecosystem.

Enhancing working capital access to SMEs through digital platforms and ecosystem connectivity

Small and mid-market enterprises (SMEs) continue to face significant barriers to accessing timely and affordable working capital, reflected in the widening trade finance gap, which reached $2.6 trillion in 2023. In response, banks are upgrading their trade finance platforms to improve efficiency and expand financing access for smaller businesses. According to the TABInsights Asia Pacific Trade and SCF Survey 2025, 55% of respondents identified inclusive access of trade finance for SMEs as the fourth most important key theme.

Banks are modernising their platforms to lower the barriers SMEs face in securing trade financing. For instance, Bank Mandiri’s Kopra platform facilitates a wide range of trade finance services, such as LCs, guarantees and invoice financing, while focusing on SMEs. By assessing real trade activity rather than relying solely on traditional credit metrics, Kopra enables SMEs to obtain financing without requiring substantial collateral or an extensive credit history.

Building on this, Kopra also strengthens SCF by offering working capital solutions to suppliers, particularly in industries like automotive and fast-moving consumer goods. By facilitating access to financing based on validated invoices or sales orders, Kopra removes the need for conventional buyer approvals and accelerates fund disbursement. This streamlined process helps SMEs better manage working capital thereby improving the overall flow of financing across supply chains.

Despite these advancements, many digital trade platforms continue to operate in silos, limiting data interoperability and industry-wide collaboration. As the sector moves toward standardization, there is growing emphasis on platform connectivity, enabled by common data standards and open APIs, to foster collective digitalisation across the trade ecosystem.

Several banks in Southeast Asia are participating in regional initiatives aimed at enabling broader ecosystem connectivity. These initiatives go beyond connecting buyers and sellers and extend to banks, logistics providers, customers, ports, and other stakeholders. One key example is Singapore Trade Data Exchange (SGTraDex), a digital infrastructure that facilitates secure data sharing across the supply chain. Recently, SGTraDex partnered with the Trade Finance Registry (TFR) — a national banking utility established to strengthen transparency and integrity in trade finance — to introduce real-time BL Genuineness Check. This industry-wide solution allows member banks to verify the authenticity of BLs, enhancing risk mitigation and reducing fraud.

For corporate treasurers, such ecosystem connectivity improves supply chain visibility and strengthens documentation integrity. By enabling seamless connection between banks, logistics firms, port authorities and other participants, these platforms reduce friction, lower costs and accelerate trade finance workflows, delivering greater value across the financing ecosystem.

Supply chain resilience emerges as top priority amid escalating geopolitical tensions

Sweeping reciprocal tariffs tied to “America first” policies continue to reshape global supply chains, prompting the formation of regional trade clusters such as ASEAN and Mexico. This shift is driving a sustained relocation of manufacturing away from high-tariffed markets like China, with investment flows diversifying into countries such as India, Taiwan and Vietnam.

As companies rethink their physical supply chains, financial supply chain must also evolve. Businesses are diversifying risk by reducing dependence on a single bank or geography, opening new opportunities in different markets. This transition has led to increased financing, long-term investment, and deeper collaboration between banks and corporates, with resilience now central to supply chain strategy. According to the TABInsights Asia Pacific Trade and SCF Survey 2025, 45% of respondents identified supply chain resilience as the fifth most significant theme.

Supply chain management is no longer solely cost-driven. Instead, strategies are shifting to prioritise risk mitigation, security and operational efficiency to better withstand future shocks. For supply chain managers, this requires more than a reassessment of procurement or supplier relationship — it calls for greater visibility and the integration of digital tools to monitor inventory, track orders and strengthen supplier relationships.

Resilience today extends beyond buffer stocks and contingency planning; it involves embedding real-time data, analytics, and automation to build adaptive and transparent supply chains. In line with this, 45% of respondents in the TABInsights Asia Pacific Trade and SCF Survey 2025 identified the deployment of supply chain visibility tools —such as real-time dashboards, invoice tracking, and cash flow analytics —as a key best practice for enhancing resilience.

In today’s increasingly complex global supply chains, visibility and control over cash flows, receivables and liabilities are critical to managing financial risk and liquidity. Techcombank’s fully online SCF platform — covering accounts payable, distributor, and supplier-led invoice financing — has improved liquidity across the value chain by enabling early payment access for suppliers and extended payment terms for buyers. Digital onboarding and API-based workflows support faster decision-making and real-time tracking of invoices and payments. While these tools enhance visibility for Tier 1 suppliers, adoption beyond the first tier remains limited due to onboarding challenges and legacy system constraints. To address this, Techcombank bank plans to launch the e-Trade Project in 2025, a digitised trade finance platform aiming to improve accessibility and process efficiency.

Deutsche Bank has enhanced supply chain transparency through client dashboards embedded in its Trade Finance Gateway. These dashboards provide real-time analytics to buyers, suppliers, financial institutions, and logistics providers, ensuring up-to-date visibility into the status of goods, documents and payments. By enabling data sharing across the trade ecosystem, the platform helps businesses maintain tighter control over operations and build supply chain resilience.

Similarly, DBS has implemented real-time visibility tools to help corporates respond swiftly to evolving trade dynamics. Its Liquidity Management Dashboard consolidates account balances, transaction trends and trade and loan utilisation across both DBS and non-DBS accounts. This unified view enables centralised decision-making across entities, currencies and markets. The dashboard’s modular, self-service features support flexible liquidity structuring — including automated consolidation, account rationalisation and pooling — to optimise internal fund usage and reduce reliance on short-term credit.

A future predicated on generative AI and tokenisation

Looking ahead, emerging technologies such as generative AI and tokenisation are expected to play an increasingly transformative role in trade finance. Generative AI can help streamline internal processes, extracting and inputting key data from documents, regardless of format, reducing manual effort and improving accuracy.

The industry is also exploring the use of tokenised trade finance assets such as export and import loans, LCs and BLs. Tokenisation offers the potential to enhance operational efficiency and automate traditionally manual processes. By creating digital representations of trade assets, tokenisation can reduce reliance on slow, costly legacy systems and broaden investor access to trade finance through improved infrastructure and transparency.

A notable example is OCBC’s partnership with Ant Group to launch a tokenised deposit initiative aimed at improving cross-border fund settlements. The solution integrates blockchain-based solutions into trade finance workflows, converting traditional deposits into digital tokens to enable secure, efficient cross-border transfers, without the delay or expenses associated with traditional payment systems.

The shift towards digitalisation and automation is not only reshaping how trade transactions are executed but also transforming the entire trade finance ecosystem. With increased regulatory support, rising adoption of digital platforms and the integration of new technologies such as AI and tokenisation, trade finance is becoming increasingly digital, connected and agile. For corporate treasurers, trade financiers and supply chain practitioners, embracing these developments will be key to improving efficiency, reducing costs and building resilience in a fragmented global market.