- Digitalisation stays firm at the top of trade transformation agenda

- The increasing burden of AML checks and ‘false positives’ add significantly to the cost of compliance

- The digitalisation of trade finance services and measures to combat counterparty risks occupy the mind of trade financiers

The ongoing slowdown in global trade, exacerbated by the US-China trade tension, has reduced transaction volume, increased compe- tition and eroded margins in the trade finance business. This situation may have inadvertently accelerated banks’ quest to reduce costs and improve profitability. Moreover, corporates’ growing demand for shorter processing time, greater visibility and automation of processes, coupled with the need to mitigate the growing risk from trade-based fraud and anti-money laundering (AML) and sanction violations have driven trade finance providers to explore and implement agile digital trade solutions.

This year’s Asian Banker annual survey of trade finance trends highlights swathe of chal- lenges such geopolitical uncertainty impacting trade relationships, associated shifts in supply chain patterns, tighter know your customer (KYC) legislation, emerging technology and lack of wider adoption of industry standards, all making trade digitalisation a rather tough climb. Commercial banks are recognising these chal- lenges, and rolling out customised/structured trade finance solutions to cater to specific client need. Banks are also accelerating innovation of electronic/paperless trade processes, and upgrading online product/channel facilities to reinforce core bank-enterprise relationship. The best practices identified in the survey include conversion of manual procedures to reduce pro- cessing time across wider ecosystem, strength- ening KYC processes for earlier risk detection and streamlining due diligence processes.

Digitalisation stays firm at the top of trade transformation agenda

Regional banks’ digitalisation efforts are increasing in momentum;from cross-border instant e-payments us- ing QR codes,which cater to chang- ing patterns of intra-Asian demand, to collaborating on blockchain con- sortiums. Banks are also developing consensus solutions such as invoice financing on blockchain, applying Robotics Process Automation (RPA) or Artificial Intelligence (AI) to in- crease productivity. Notably there is an increasing desire to automate market operations and make digi- talisation scalable.

China’s rebalancing of growth from exports and investment to consump- tion is fueling import demand for high-tech consumption goods such as that of electronics. Banks in Hong Kong are leveraging closer proximity to Mainland and lower funding costs from stronger USD liquidity to expand cross-border trade finance facilities. Both, Bank of China (Hong Kong) and Hang Seng Bank commenced process- ing of transactions with customers to submit trade documents and apply for trade finance application on eTra- deConnect, a cross-bank trade finance blockchain platform. Wider adoption is expected to drive standardisation and reduce the processing time of transactions and costs from traditional paper documentation.

There is a push from the Reserve Bank of India (RBI) to reduce over- reliance on domestic instrument by local banks, underscoring the need to shift toward globally accepted trade finance instruments. To drive new synergies and value creation, Kotak Mahindra Bank observes that fintechs are becoming an integral part of trade ecosystem. It recently partnered with a fintech for extending financing and currently leverages its expertise in doing underlying documentary checks. Yes Bank deployed predictive analytics and data management tools to monitor fraud detection at various levels and draws inferences to make information flows seamless.

There is a declining demand for plain vanilla trade products for ex- ample, corporates in Indonesia look for more sophisticated, and capital optimising solutions compared to traditional products. This has led Bank Mandiri to launch a front-end web-based system which integrates relevant APIs with customers to facilitate their complex transactions. Meanwhile, in Southeast Asia, United Overseas Bank (UOB) of- fered solutions to help clients manage their physical and financial supply chain. This development is against the backdrop of rising diversification in production and sourcing patterns resulting from trade frictions and the subsequent investments and trade expansion into the region.

Others such as Metrobank and RHB Bank Group are focusing atten- tion to ease clients pain points at the back of changing macro-economic dynamics and its structural impact on specific industries.

Banks are betting high stakes on the promise of blockchain technology to increase automation, transparency and manage risks from trade and supply chain financing. For instance, Sri Lanka’s Hatton National Bank partnered with a fintech to enable blockchain-based domestic and cross-border trade finance network. Currently, at pilot stage, it includes the bank’s correspondent partners and their corporates clients. Notably, Thailand’s Bangkok Bank invested in R3, a consortium of leading global banks trialling blockchain, for cross- border interbank transactions.

Re-location of parts of production and supply chain processes by global manufacturing firms to the Vietnam- ese market, has accelerated the pace of trade-related investment. To remain competitive, domestic banks such as Vietcombank invested in new trade finance software to deal with the surg- ing transaction volumes and mitigate operational risks. VietinBank proac- tively collaborated with international banks to promote large business flows while tapping into the knowledge of new potential markets.

Deutsche Bank noted on the emer- gence of blockchain networks, such as VoltronX, Marco Polo and we.trade, and regulator-driven trade platforms, particularly in Hong Kong, Singapore and UAE, as critical drivers offuture connectedness of cross-border trade ecosystems. The bank is one of the founding members of Trade Infor- mation Network (TIN), a new multi- bank initiative that seeks to connect corporates to financing opportunities in their supply chains.

The increasing burden of AML checks and ‘false positives’ add significantly to the cost of compliance

While some banks may have reduced or even terminated correspondent banking and client relationships to bring down operational costs and preserve profitability, compliance is one area where banks and financial institutions (FIs) cannot easily cut back on expenses.

Risks from reputational damage further obligate banks to screen both their clients and individual transactions. That said, they have a significant role to play in identify- ing and managing red flags in trade finance. Banks and FIs are deploying new technologies or adopting initia- tives that meet the requirements of KYC identity verification.

The proliferation of cyber frauds across banking networks has driven banks such as Kotak Mahindra Bank to implement RBI’s mandates to rou- tinely sensitise resources on cyber threat incidents through an online training module. In addition to deploying predictive analytics and big data tools to monitor suspicious transactions, Yes Bank enabled online viewing of regulatory pendencies in its trade portal.

To improve returns to offset the cost of capital from the implemen- tation of BASEL III standards, RHB Bank in Malaysia implemented ‘total customer profitability’ framework and focused attention toward sup- ply chain financing from traditional trade financing.

HSBC’s Taiwan banking unit ob- serves credit and financial crime risks as key determinants while onboard- ing new clients. It strengthened KYC processes and tools to undertake early risk identification.

In 2019, State Bank of Vietnam tightened credit expansion to check foreign currency lending by Vietnam- ese banks. VietinBank subscribed to a comprehensive ‘limit tracking engine’ as a part of financing SME companies. The developed techni- cal system is capable of screening a robust number of invoices to assist the bank in risk management.

Digital resilience is the to-go theme as institutions make strives to achieve better, faster and easier processes, although safety and soundness remain critical. As risks from cybersecurity warrant greater attention and resources, Deutsche Bank implemented controls throughout bank’s architecture. A dedicated cyber team applies combinations of technologies such as AI, machine learning (ML), RPA and Optimal Character Recogni- tion (OCR) to combat trade-based money laundering.

There is no doubt that the pace of transformation has quickened, although meeting common standards to achieve interoperability of solu- tions remains a big hurdle. Progress remains largely siloed with the mul- tifaceted nature of trade transactions, each with specific legal requirements with multiple participants to one transaction. To counter these, play- ers need to move together on their digitalisation initiatives that link up to the wider industry.

The digitalisation of trade finance services and measures to combat counterparty risks occupy the mind of trade financiers

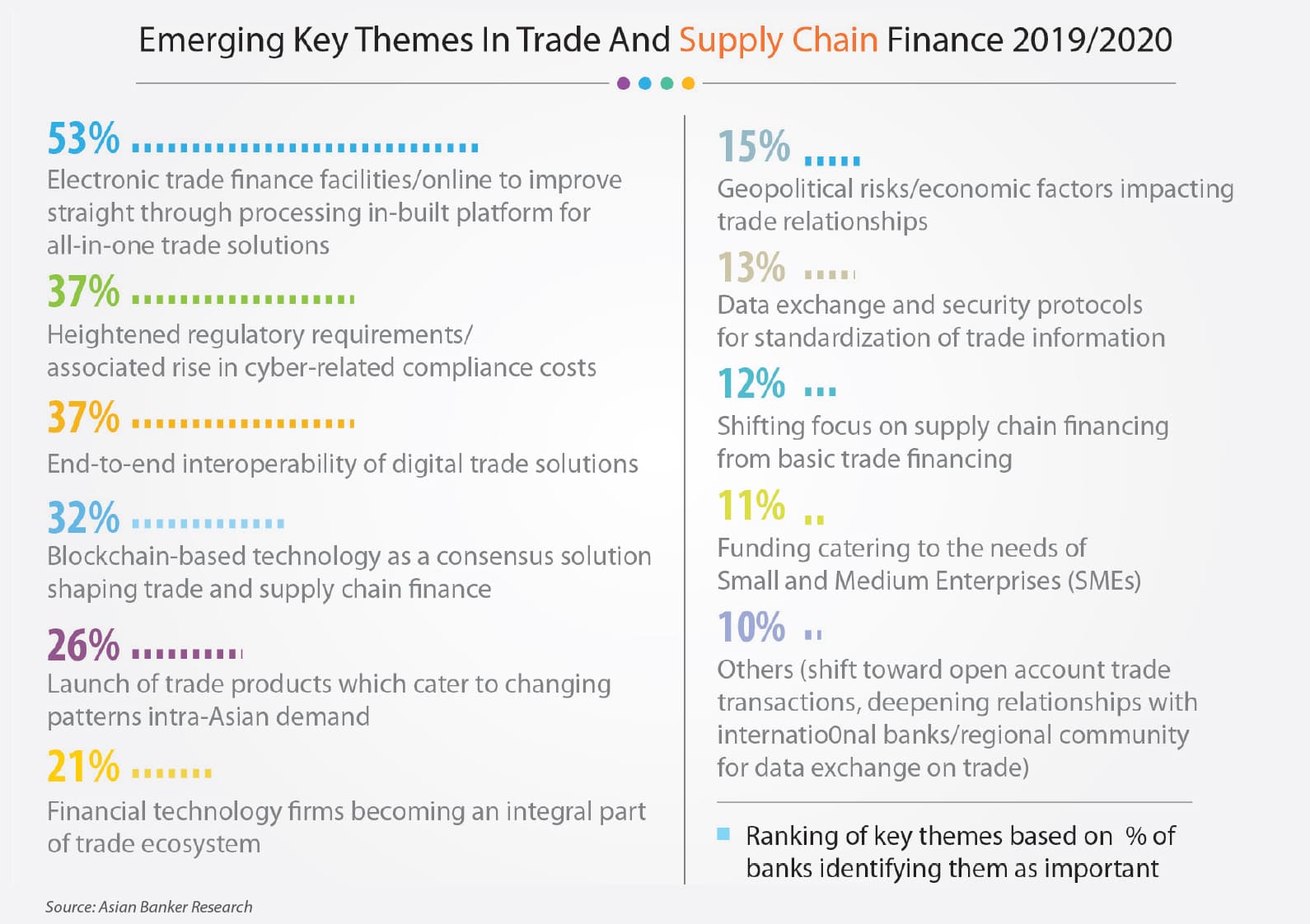

Figure 1: Emerging Key Themes in Trade and Supply Chain Finance 2019/2020 based on % of banks identifying them as important