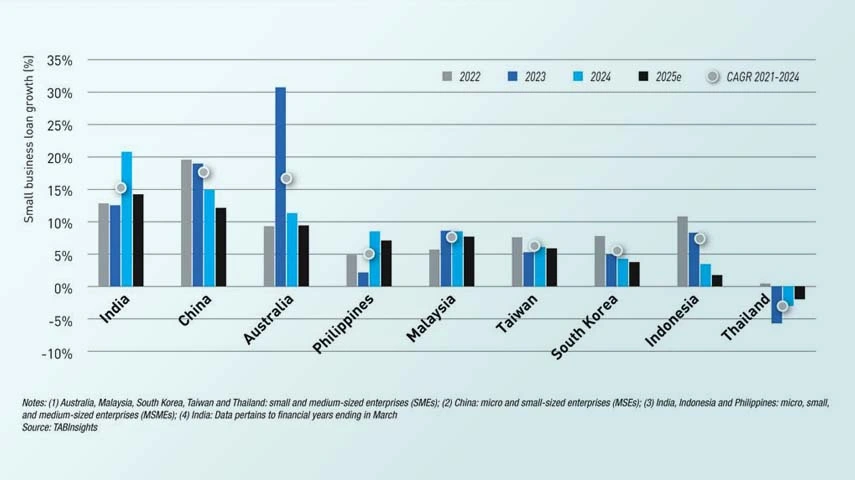

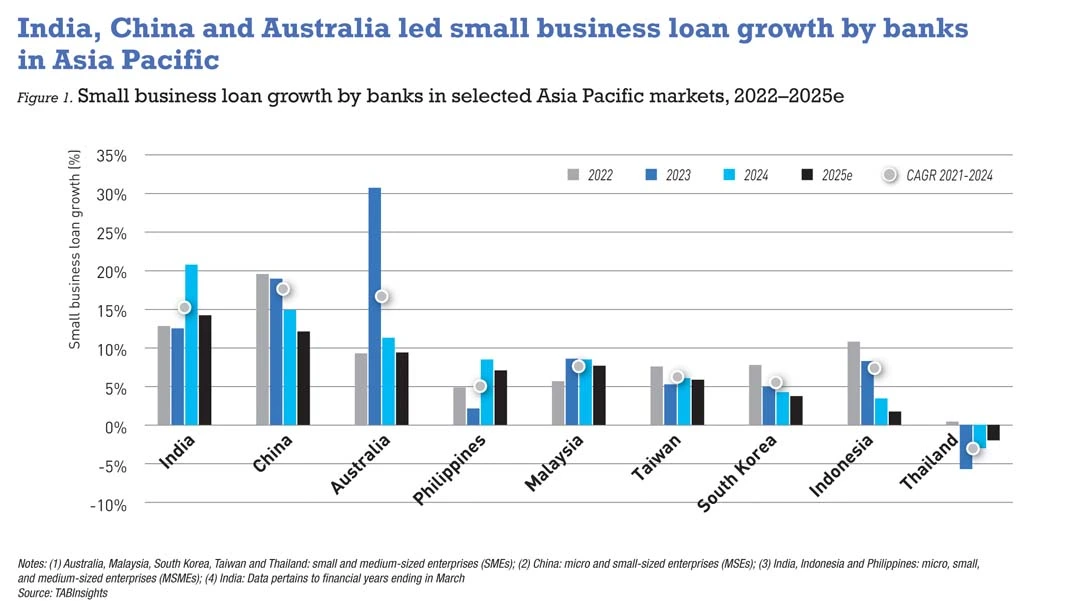

Across nine selected Asia Pacific markets, average growth in small business bank loans declined from 9.4% in 2023 to 8.2% in 2024. This slowdown was mainly driven by reduced lending activity in Australia, China and Indonesia. Despite this deceleration, India, China and Australia remained among the fastest-growing markets for small business lending. Other economies showed mixed trends, reflecting uneven credit conditions.

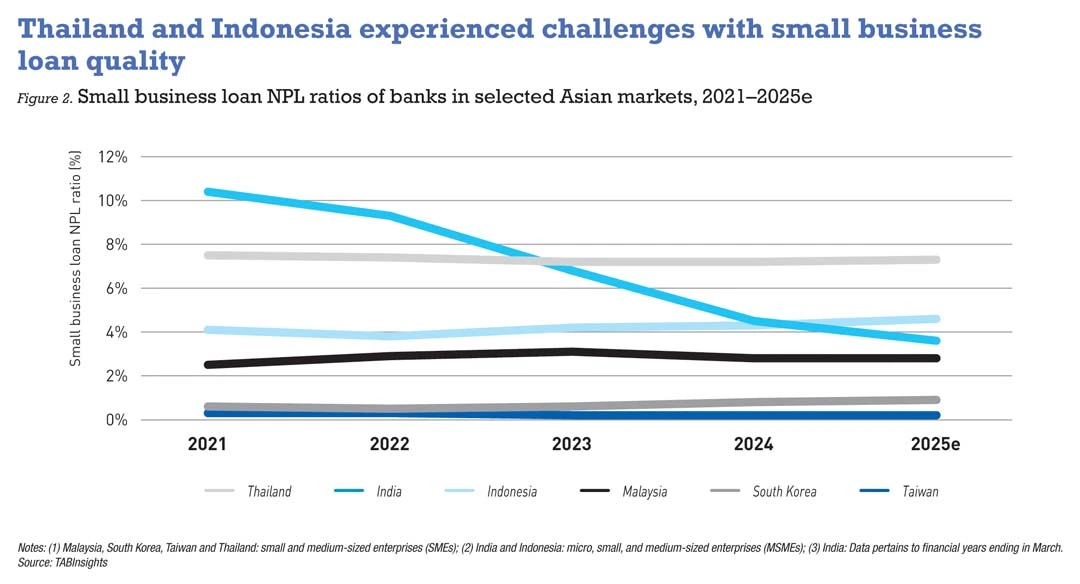

Access to bank credit varies widely across the region. Structural reforms and digital initiatives have expanded formal credit access and financial inclusion in some markets. However, macroeconomic uncertainty, rising credit risks and cautious bank lending constrained growth elsewhere. Thailand and Indonesia experienced subdued or negative growth alongside persistently high non-performing loan (NPL) ratios, highlighting ongoing asset quality challenges. Although the Philippines saw a rebound in small business loan growth, financing constraints remain.

Leading markets maintain momentum

India, China and Australia recorded the strongest growth in small business loans, fuelled by strong credit demand, accelerating formalisation and ongoing policy support. India saw micro, small and medium enterprises (MSME) loan growth accelerate from 13% in the financial year (FY) 2022 to 21% in FY2024, supported by initiatives such as Udyam registration, GST Sahay, the Trade Receivables Discounting System (TReDS), credit guarantee schemes, and expanded digital public infrastructure. Although growth moderated in FY2025, it remained above the regional average. Asset quality improved markedly, with the MSME NPL ratio falling from 10.4% in FY2021 to 3.6% in FY2025.

In China, micro and small enterprise (MSE) loan growth eased from 19% in 2022 to 15% in 2024. Despite the slowdown, China sustained the region’s highest compound annual growth rate (CAGR) from 2021 to 2024, reflecting continued government support amid macroeconomic challenges including property sector stress and weak private consumption.

Australia’s small and medium enterprises (SME) loan growth surged to 30% in 2023, driven by a strong post-pandemic recovery and active bank support. Growth normalised to 11% in 2024, signalling a return to more sustainable expansion.

Pressures mount in weaker markets

Indonesia and Thailand faced weak or negative small business loan growth due to factors including macroeconomic uncertainty, soft credit demand, cautious bank lending and structural barriers such as limited collateral and credit history.

Indonesia’s MSME loan growth slowed sharply from 11% in 2022 to 3.4% in 2024, while the NPL ratio increased from 3.8% to 4.3%. This reflects a prolonged MSME recovery, weakened household purchasing power and fiscal priorities focusing on infrastructure over household consumption, alongside an increase in value added tax. Elevated credit risks led banks to adopt a cautious lending stance.

To tackle asset quality concerns and revive credit growth, Indonesia issued Regulation No. 47/2024, permitting state-owned banks to write off bad MSME loans without legal consequences. The Financial Services Authority (OJK) is also preparing stimulus measures and regulatory frameworks to boost MSME lending in 2025. Nonetheless, credit growth is likely to remain weak in the near term.

Thailand was the only market to record negative SME loan growth in 2023 and 2024, with contractions of 5.7% and 3%, respectively. The SME NPL ratio remained elevated at 7.2% in 2024, though slightly lower than 7.5% in 2021. The decline reflected the withdrawal of pandemic-era support, subdued credit demand and tighter lending standards. Banks became more cautious, particularly towards smaller or seasonal SMEs lacking collateral or formal financial records, amid rising credit risks.

While government initiatives such as green productivity loans, debt relief, and credit guarantees have been introduced, their impact remains constrained by strict eligibility requirements and standardised risk pricing. Additional support is anticipated through targeted soft loans for underserved regions and closer collaboration between the Bank of Thailand and the government. Priorities also include revamping guarantee schemes, improving SME credit data systems, and expanding financing options, creating conditions for a gradual recovery as formalisation and digitisation progress.

MSME financing remains constrained in the Philippines

The Philippines experienced a rebound in MSME loan growth to 8.4% in 2024, following a slowdown to 2.1% in 2023. This improvement was driven by enhanced macroeconomic stability, policy rate cuts, and a reduction in reserve requirements that boosted banking liquidity. However, MSME financing remains significantly constrained, constituting only 4.86% of banks’ total loan portfolios at the end of 2024, far below the mandatory 10% target. Despite penalties, many banks continue to miss this quota due to persistent challenges such as high credit risk, insufficient collateral, and limited borrower documentation, all of which hinder lending to MSMEs.

Rigid corporate-style credit standards, including audited financial statements and formal collateral, further restrict access for many MSMEs which often operate with informal records and volatile cash flows. Consequently, many small businesses resort to pawnshops and alternative lenders. There is growing demand for proportionate regulation and alternative risk assessments based on cash flow, character and relationship history to better reflect MSMEs’ realities and bridge the persistent financing gap.

Small business bank lending growth across Asia Pacific remains uneven. While some markets are positioned for further expansion, others face ongoing constraints from credit risk, weak demand and institutional challenges. The outlook will depend on each economy’s ability to strengthen credit infrastructure, improve borrower quality and adapt to evolving financial conditions.