- E-commerce platforms are gaining a foothold in the African retail industry

- Three economies continue to dominate the e-commerce landscape in sub-Saharan Africa

- Mobile technology is fuelling the e-commerce growth in Sub-Saharan Africa

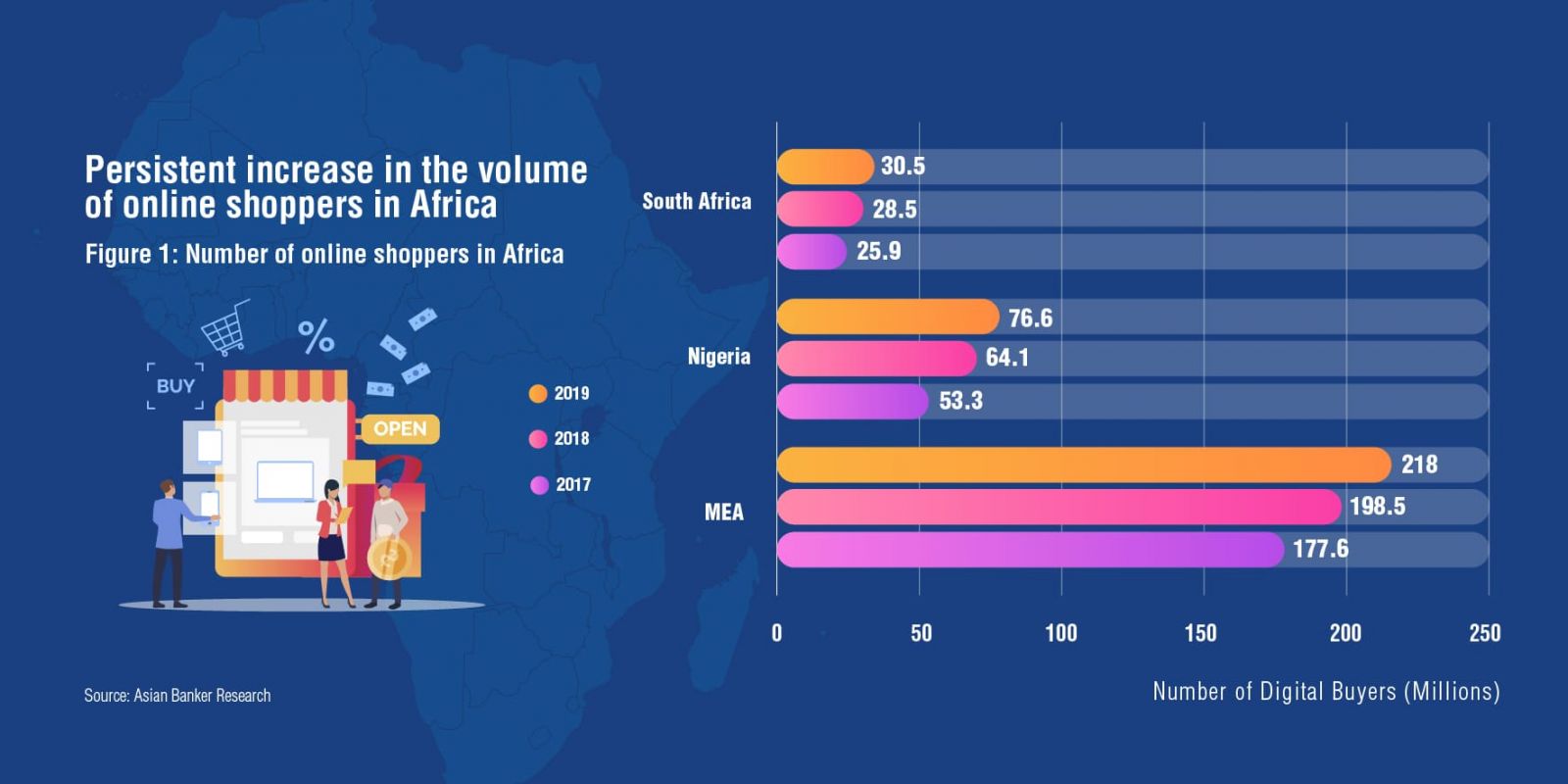

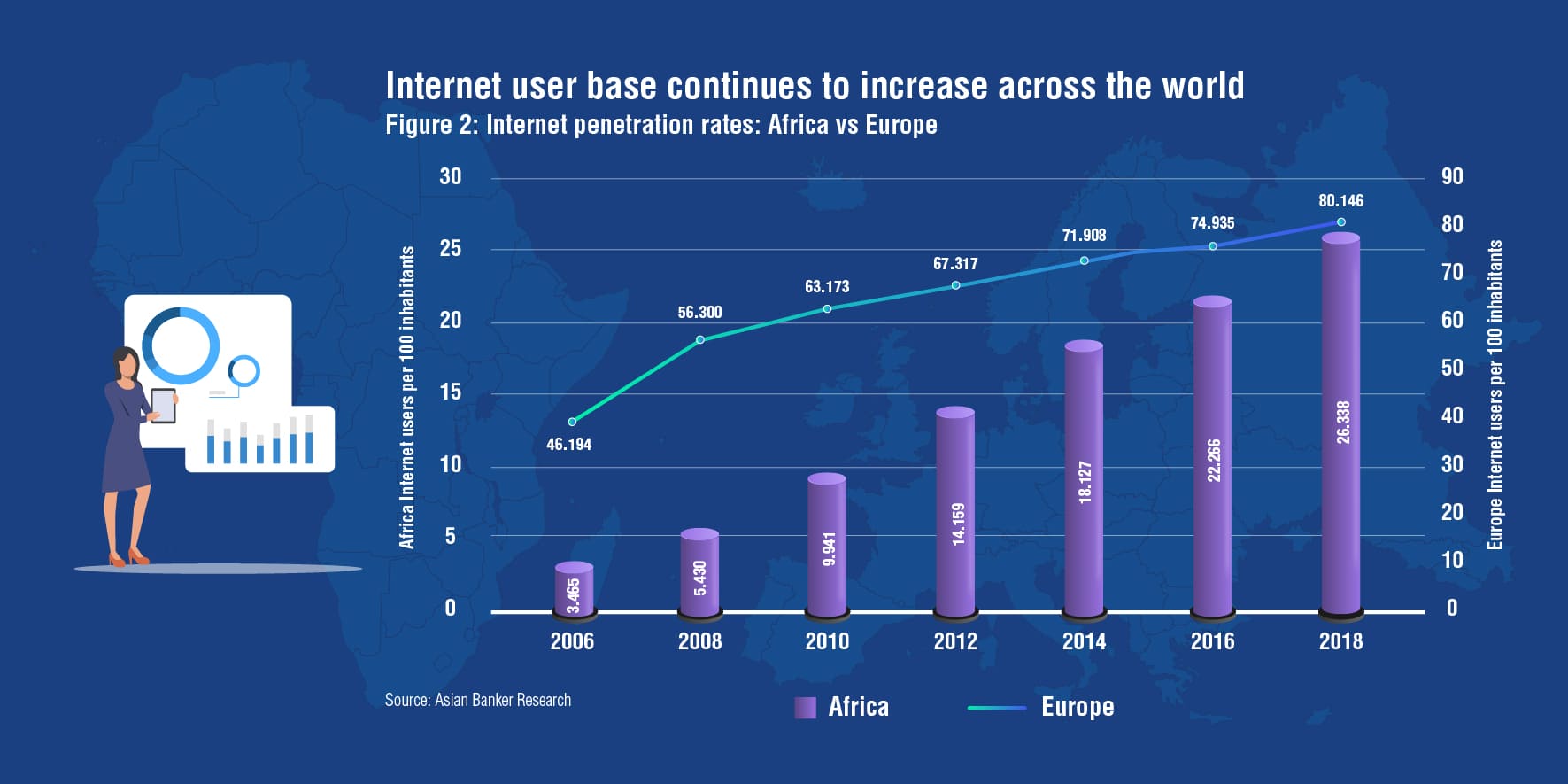

E-commerce is increasingly disrupting the retail industry in Sub-Saharan Africa. The United Nations Conference on Trade and Development (UNCTAD) reported that the number of online shoppers in Africa surged annually by 18% since 2014. The rapid Internet penetration through smartphones over the past decade largely contributed to the growth of Africa’s e-commerce. The International Telecommunication Union statistics also revealed that the share of the population using the Internet increased from 2.1% in 2005 to 24.4% in 2018. Furthermore, Africa’s payments services architecture is evolving in response to changing customer expectations and technology, offering a range of disruptive payment models enabling more people, even without a bank account, to take part in online shopping.

Technological advances and innovation have undeniably played a critical role in the adoption of online selling and purchasing in Africa. For instance, multinational payments company Cellulant built Africa’s first augmented reality-powered try-on experience in Facebook Messenger, enabling customers to search and try the products before purchasing them on the online platform Mula Shops.

In several African countries, e-commerce is used to extend retail services to small towns and the rural population, where there is limited choice of goods available. Retailers are increasingly leveraging on technology to drive sales and to better engage with customers. Statistics portal Statista reported that the total value of e-commerce in Africa reached $16.5 billion in 2017 and is expected to reach $29 billion by 2022. Although e-commerce is spreading steadily in Sub-Saharan Africa, three economies continue to dominate the e-commerce landscape. According to the UNCTAD E-commerce Index Report 2018, Nigeria, South Africa and Kenya account for more than half of the online shoppers in Africa in 2017. Nigeria is Africa’s largest business to consumer e-commerce market in terms of both number of shoppers and revenue.

Though Sub-Saharan Africa’s e-commerce industry is growing, online retail is still in its infancy in the area as e-commerce accounts for a small share of total retail sales on the continent. According to Alastair Tempest, chief executive officer of Ecommerce Forum of Africa, several factors are inhibiting the e-commerce market from reaching its full potential in Africa and these include low levels of Internet penetration, high cost of broadband for Internet access, lack of a national street address system, general distrust on online transaction, low bank card penetration and limited e-commerce payment options. Paradoxically, the same factors are encouraging the development of innovative solutions for online shopping in Africa.

Overcoming payments hurdles in Sub-Saharan Africa

A significant share of the African population remains unbanked as affirmed by the International Monetary Fund’s estimate that only 20% of the population have a bank account. In developed countries, a large proportion of payments for online purchases are done using bank cards but this payment channel is not optimal for Africa. Due to low penetration of bank cards and other structural deficiencies, e-commerce operators in Sub-Saharan Africa face unique challenges compared to their counterparts who operate in the developed world. More recently, innovative payment options have surged in Africa in a bid to address specific payment issues. Mobile-based payment solutions have also emerged as the main driver of the African e-commerce revolution, as these have mitigated the payment barriers to e-commerce.

While cash on delivery is the preferred payment method by online shoppers in Africa’s e-commerce market, there are also many risks and inefficiencies that come with it. One is higher operating costs. In an attempt to grow their sales efficiently, several e-commerce companies have introduced some initiatives aimed at improving the payment experience and options.

Jumia One app is one example of how mobile technology is fuelling e-commerce growth in Africa. Jumia, the first unicorn and now the largest e-commerce player in Africa, launched Jumia One app which provided users with access to all of Jumia’s services, such as payment transactions, shopping and advertising goods on the platform. The users can pay for purchases through PayPal and major card brands while Jumia’s integration with M-PESA, a mobile money solution, enabled its customers to pay for their purchases via M-PESA in Kenya.

Throughout Africa, there is a rise in the number of fintechs disrupting the payment industry.

Several fintechs provide innovative payment solutions designed to address payment issues in Africa’s e-commerce landscape. The strategic partnership between Nigeria’s Interswitch Limited and Visa will undeniably advance the digital payments ecosystem across Africa. Interswitch, in addition to its switching and processing services, is operating the payment platform Quickteller. This multichannel consumer payments platform is driving e-commerce growth as well as financial inclusion across Nigeria, as the fintech has numerous access points from which users can initiate peer-to-peer transfers, bill payments, airtime purchases and other e-commerce transactions. In 2018, Interswitch launched its new product Quicktellers Global Mall as an added feature to its Quickteller electronic payment platform, which enabled users to shop directly from a large range of online stores from the United Kingdom and United States, while paying for the products in their local currency. This service tackled the problems associated with shopping on international sites, such as payment methods and exchange rates.

VoguePay launched a digital banking platform branded VoguePay3.0. The multi-currency payment platform allowed merchants to accept payment in British pound, Ghanaian cedi, euro, South Africa rand, Nigeria naira, US dollars, Kenyan shillings and bitcoin, enabling them to sell their products to global customers. This application improved e-commerce transactions in Africa as it enabled merchants to give their customers more online payment options ranging from mobile payment, wallet transfers, subscription billing, Internet banking, QR codes to bitcoin payment.

Although South Africa has a higher Internet penetration rate and percentage of banked population compared to other Sub-Saharan African countries, one of the main factors hindering its e-commerce growth is its low credit card penetration rate.

Paris Philippou, e-commerce and digital director at Massdiscounters, noted that it’s critical for Africa to find unique solutions for its ecommerce constraints. He also shared his concern about the relatively passive role that the traditional banks are playing in regards to promoting e-commerce. Although some banks and fintechs are partnering together to provide payment solutions for e-commerce in Africa with a focus on the unbanked, they are few. Kenya’s Family Bank Limited and SimbaPay, a financial technology firm, joined forces to offer an instant money transfer service that enabled Family Bank Limited or M-PESA customers in Kenya to send money from their mobile app to WeChat users in China. This initiative connected China’s largest payment service and Africa’s largest mobile money ecosystem in real-time and it simplified the payment process especially for those without bank accounts. More recently, UnionPay International, I&M Bank and iVeri collaborated to provide online access to UnionPay cardholders across Kenya, Tanzania and Rwanda. This integration also enabled iVeri to enhance the card acceptance offering for merchants that use its gateway. The collaboration increased the payment convenience of UnionPay cardholders transacting in Africa, especially when transacting through I&M Bank’s network of e-commerce merchants. The step also further improved online payments between China and Africa.

FNB launched the eCommerce Switch, which is their payment gateway to process online sales for e-commerce merchants. With the eCommerce Switch solution, merchants receive real time instant payment approvals enabling faster delivery of products to online shoppers. The payment solution has transport layer security and 3-D secure for all e-commerce transactions and offers an online portal with reconciliation, risk and transaction reporting.

Navigating around concerns of lack of trust in online commerce

Distrust is one of the main impediments to shopping online in Sub-Saharan Africa. Due to the importance of establishing trust in e-commerce, the Ecommerce Forum South Africa (EFSA) launched Africa’s first E-commerce Trustmark, a badge provided to e-commerce platforms that are compliant with EFSA's South African Code of Conduct checklist. E-commerce Trustmark assists online businesses in sharing with their customers that they passed the security and privacy tests, proving that their online transactions are safe. Some e-commerce companies offer escrow services to navigate the customer trust issue.

A number of fintechs have developed trust-centred solutions to promote online shopping. Mobicred is an online credit product offering a centralised account that users can access across a number of merchants. The product provides online shoppers the option to buy now and pay at a later stage. This was designed for individuals who are reluctant to use actual credit cards to make online purchases due to fear of cyber fraud or those that may be cash strapped and not in possession of a credit card.

Though the e-commerce industry is booming in Africa, there is still a need to address the issues hindering the full potential of the e-commerce industry. Adewale Adejumo, founder of Zasttra.com, highlighted that the slow rate of innovations in Africa’s e-commerce landscape is a major deterrent to the growth potential of the industry. In order to further facilitate the growth of Africa’s e-commerce market, it essential that online stores offer a wider variety of secure payment options so that online shopping is more accessible for everyone. Given, the high proportion of unbanked population in Sub-Saharan Africa, more e-payment innovations leveraging on mobile money can potentially stimulate further growth of e-commerce in the region.