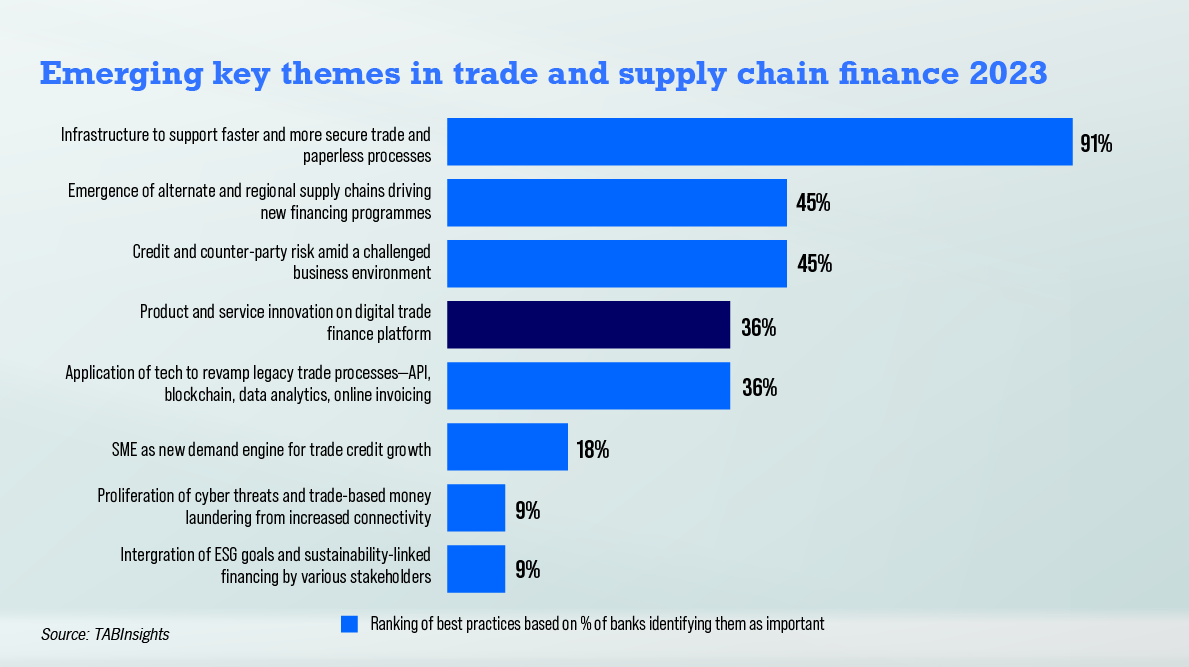

Trade finance is gradually digitalising amid evolving e-commerce models, driven by technology and sustainability; the $2.5 trillion global trade finance gap affecting SMEs prompts innovation in blockchain, tokenisation, and sustainability, despite geopolitical complexities